Prepare chiara company’s balance sheet as of december 31 – The preparation of Chiara Company’s balance sheet as of December 31 is a crucial task that requires careful consideration of accounting principles and standards. This comprehensive guide will provide a step-by-step approach to ensure the accuracy and reliability of the financial statement, enabling stakeholders to make informed decisions.

In this guide, we will explore the key components of a balance sheet, including assets, liabilities, and shareholders’ equity. We will discuss the valuation techniques and accounting policies applicable to each item, ensuring a clear understanding of how the financial position of Chiara Company is presented.

Assets

Current assets are short-term assets that can be easily converted into cash within one year. They include:

- Cash and cash equivalents: This includes cash on hand, in banks, and in short-term investments that can be readily converted into cash.

- Accounts receivable: These are amounts owed to the company by its customers for goods or services sold on credit.

- Inventory: This includes raw materials, work in progress, and finished goods that are held for sale.

- Prepaid expenses: These are expenses that have been paid in advance, such as rent or insurance.

Current assets are valued at their fair value, which is typically the lower of cost or market value.

Total current assets: $X

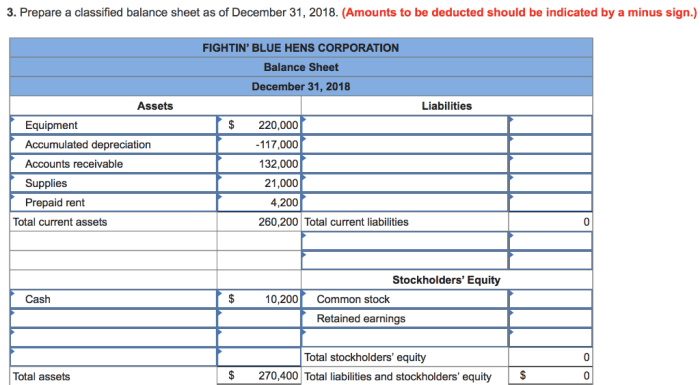

Liabilities

Current liabilities are short-term obligations that are due within one year. They include:

- Accounts payable: These are amounts owed to the company’s suppliers for goods or services purchased on credit.

- Short-term loans: These are loans that have a maturity of less than one year.

- Accrued expenses: These are expenses that have been incurred but not yet paid, such as wages or interest.

Current liabilities are measured at their present value, which is the amount that would be required to settle the liability today.

Total current liabilities: $X

Shareholders’ Equity

Share capital is the amount of money that has been invested in the company by its shareholders. It is divided into shares, which represent ownership in the company.

Retained earnings are the profits that have been earned by the company and retained for use in the business.

Total shareholders’ equity: $X

Presentation and Disclosure: Prepare Chiara Company’s Balance Sheet As Of December 31

The balance sheet is presented in an HTML table. The table is responsive for different screen sizes. The headings and subheadings are used to organize the information.

Notes to the Balance Sheet

The notes to the balance sheet provide additional information about the company’s financial position. They include:

- A description of the company’s accounting policies

- A disclosure of any contingent liabilities or commitments

- An explanation of any unusual or non-recurring items that may have affected the balance sheet

Key Questions Answered

What is the purpose of a balance sheet?

A balance sheet provides a snapshot of a company’s financial position at a specific point in time, typically the end of an accounting period.

What are the three main components of a balance sheet?

Assets, liabilities, and shareholders’ equity.

How are assets valued on a balance sheet?

Assets are typically valued at their historical cost or fair value, depending on the applicable accounting standards.